The future investment requirements for EB5 crossed a milestone in February 2025, and nobody noticed.

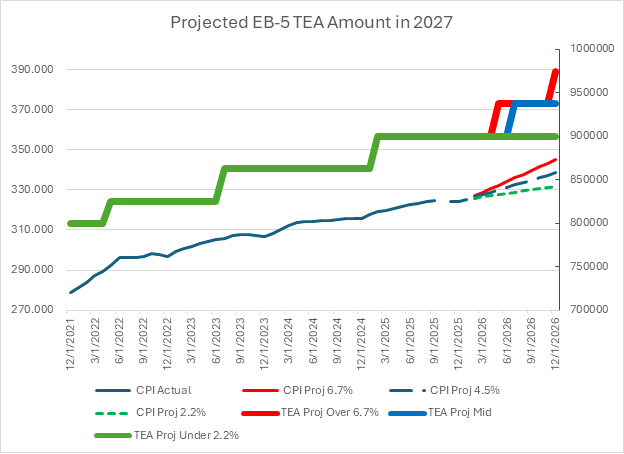

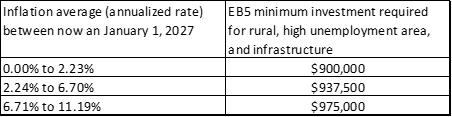

Based on the Consumer Price Index published in March 2025, the projected minimum investment as of January 1, 2027 for TEA and infrastructure projects increases to $900,000. Based on the CPI published for January 2026, we estimate that the investment threshold may remain at $900,000, but could likely increase to as much as $937,500.

Don’t be alarmed. The investment requirement is still $800,000 today. The future investment requirement is based on a formula in the law. Let me explain.

The EB-5 Immigrant Investor Program, established in 1990, had significant changes with the EB-5 Reform and Integrity Act of 2022 (RIA). Understanding this law is crucial for potential investors as it includes insight into how the United States government will handle increases in the minimum EB5 investment amount moving forward. Increases are expected to take effect in January 2027, less than 18 months from now.

Current EB5 Investment Amount

Historically, the required EB5 minimum investment was $1 million for non-targeted employment areas and $500,000 for projects in targeted employment areas (TEAs), regions characterized by high unemployment or rural status. The Reform and Integrity Act of 2022 raised these thresholds significantly to reflect economic changes since the program's inception. The new minimum EB5 visa investment amount requirement is now $1,050,000, reduced to $800,000 for TEAS and qualifying infrastructure projects.

A Mandate for Automatic Adjustment Jan. 1, 2027

The RIA law mandates automatic adjustments of the investment thresholds every five years, beginning January 1, 2027. These adjustments will be based on the cumulative annual percentage change in the Consumer Price Index for All Urban Consumers (CPI-U) reported by the Bureau of Labor Statistics. This ensures that the investment amounts remain aligned with inflation and economic conditions, preventing another extended period without adjustment.

Using CPI data from January 1, 2022, through January 31, 2026, we can calculate the impact of inflation on the investment thresholds. As of January 31, 2026, the CPI-U index was recorded at 325.252, reflecting a 16.7% cumulative change since December 2021 when it was 278.802.

The increased thresholds and automatic adjustments reflect public policy choices by Congress to ensure the EB5 program remains practical and reflects current economic conditions. This means a higher initial investment. Understanding the automatic adjustment helps investors plan their finances better, knowing that the requirements will evolve with inflation.

Planning for an Increase to EB5 Investment Amount

The changes brought by the RIA mark a significant shift in the investment landscape for prospective EB5 investors. The program aims to remain relevant and economically viable by incorporating automatic adjustments based on inflation. Investors should stay informed about these changes and consider potential future increases in their planning.

What will increases look like? According to the Peachtree Group EB5 team’s conservative calculations, in January 2027, we expect the lowest investment threshold will increase from $800,000 to either $900,000 or $937,500. Here’s how we came to this conclusion.

Projected EB-5 TEA Amount in 2027

Expected EB5 Investment Amount Increase?

The graph can be summarized as follows:

Based on these ranges, we expect, as of January 2027, the lowest investment threshold will increase to either $900,000 to $937,500.

What Can You Do Now?

No one can be certain of what the future holds, even when hypothesizing based on historical data. However, what we do know is there will be automatic adjustments to the minimum EB5 investment amount per the RIA and those adjustments are expected to take effect in January 2027, less than two years from today.

To lock in the lower EB5 investment amount, it is important to get the process started. Peachtree Group is an integrated investment management firm specializing in identifying and capitalizing on opportunities in dislocated markets, anchored by commercial real estate. Today, we manage billions in capital across acquisitions, development, and lending, augmented by services designed to protect, support, and grow our investments.

Our EB-5 Team has more than 30 years combined experience in EB-5 investments managing over $2 billion in EB-5 transactions. Learn about the Peachtree Advantage and let us help you navigate the difficult EB-5 process before investment amounts rise.

Taking the Next Steps with Peachtree

Here’s how you can begin your journey to U.S. residency with an EB-5 investment.

Visit Our Website

Start by visiting our website where you can learn more about our specific EB-5 investment opportunities.