Explore Peachtree Group's latest commercial loan transactions and financing options.

Peachtree Group is a direct balance sheet lender focused on funding first mortgage loans. Our areas of expertise include:

We lend to all commercial real estate asset classes and are actively providing financing for:

- Acquisitions

- Recapitalizations

- Construction projects

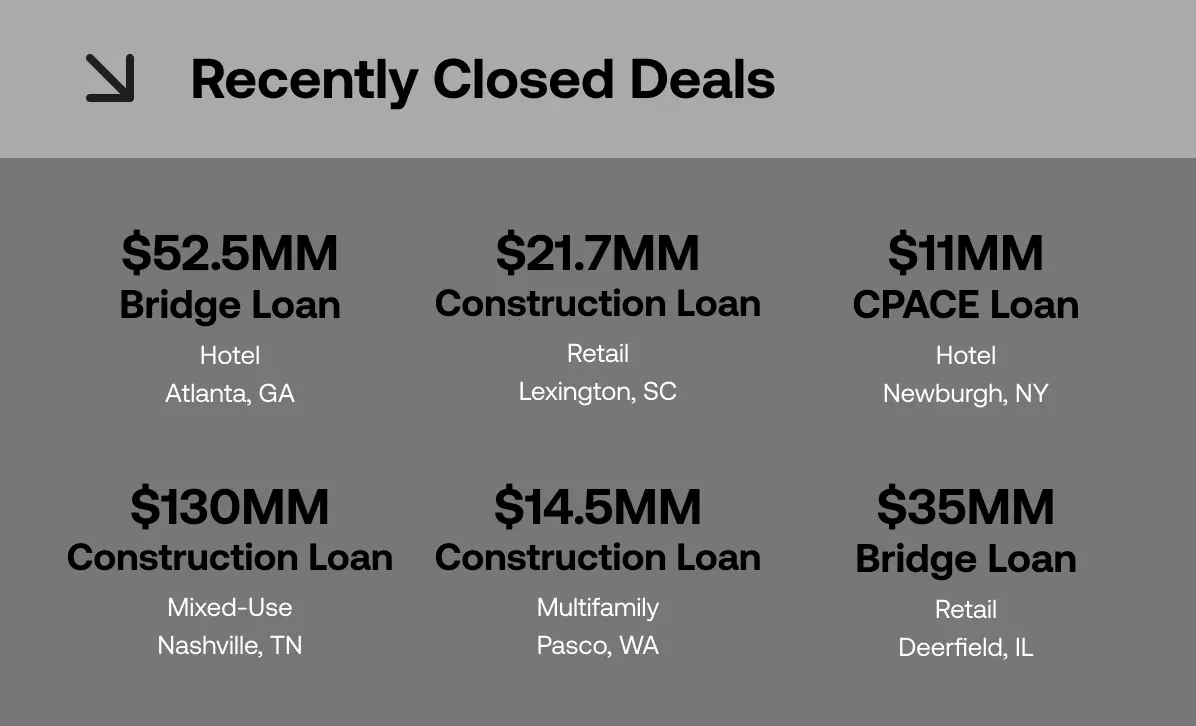

See below for some of the most recent loan transactions from Peachtree Group, including:

- Hotel loans

- Retail properties

- Multifamily developments

- Industrial assets

- Land deals

Need Financing? Contact us at lending@peachtreegroup.com.

Peachtree Group Closed 23 Loans Totaling $640MM in the Last 90 Days

December 2025 highlights

In The News & Market Views