Each month the US State Department publishes the official Visa Bulletin, which is the source for information on visa availability in the United States. It shows which approved immigrant applicants may move forward to obtain their immigrant visa based on the date the original petition was filed: If your EB-5 petition is approved by USCIS, you go to the Visa Bulletin chart to see if there is a visa currently available for you.

Update on Cut-off Dates for EB-5 Categories

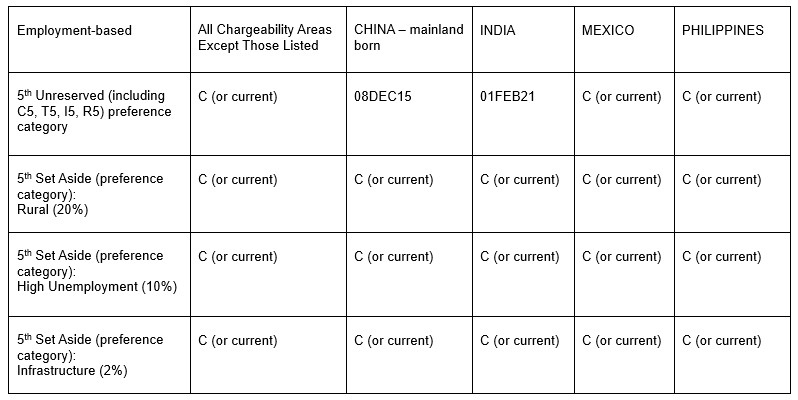

In the October 2025 Visa Bulletin, all countries remain current, including China, which remains at December 8, 2015, while India advanced by fourteen months to February 1, 2021. The November 2025 Visa Bulletin shows all three set aside categories as current.

Read below for more on how to read the Visa Bulletin.

Visa Bulletin Explained: How Many Visas Are Available?

There are 140,000 employment-based green cards available each year, with specific limits for each “preference” category. US immigration law also sets limits on the number of green cards available based on the country of origin. No single country of origin can account for more than 7% of the green cards issued across all family-based and employment-based categories.

Why are Some Countries Called Out?

Although generally not an issue for most countries, this country-of-origin cap can create backlogs for EB-5 investors from China and India. (Generally, there are not enough EB-5 applicants from Mexico or the Philippines to create backlogs for those countries, which are the only other countries subject to the country-of-origin caps.)

Potential EB-5 participants should refer to the Visa Bulletin to understand whether there are visas immediately available for them after their I-526 or I-526E petition is approved.

The chart for EB-5 from the latest visa bulletin shows the following:

November 2025: Final Action Dates for Employment-Based Preference Classes (excerpt to show just EB-5)

What do the Dates in the Boxes Mean?

This Visa Bulletin shows there is currently a backlog only for investors approved under the “old” EB-5 program, which was in place before the EB-5 Reform and Integrity Act of 2022 (the “RIA”), effective on March 15, 2022.

For Chinese and Indian pre-RIA investors, the dates are January 22, 2014 for Chinese applicants and May 01, 2019 for Indian applicants. Investors from China and India who applied under the old program after the cutoff dates listed (January 22, 2014, for China; May 1, 2019, for India) cannot immediately seek to get their visa and move to the United States. They must wait for the listed date to move forward to their petition’s application date, generally known as their “priority date”.

Note it is only the “Unreserved” preference category in EB-5 that shows a cutoff date. The new reserved preference categories for EB-5 all show as ‘C’ or “Current”, meaning anyone who has an approved EB-5 petition related to the new reserved visas created by the RIA can start the process to immigrate to the US, even those from China and India.

Key Points to Consider

- Country Cap Misconception:

Conventional EB-5 wisdom is that the country cap is calculated within each preference category, not across all preference categories. That would mean that no one country could have more than 7% of just EB-5 visas in any reserved visa category.

This is wrong.

In a US Federal Register announcement dated March 28, 2023, the US Government acknowledged they were calculating country caps incorrectly and outlined how country caps were to be calculated moving forward. Here is an article we have written to explain EB-5 visa country caps, the confusion, and why investors born outside of China and India can confidently choose between either a rural or high unemployment EB-5 project. - Cutoff Dates May Not Move Month-to-Month:

The cutoff dates do not move in lockstep with the real-world calendar. Date changes for China and India have occurred several times in the last 18 months. The latest changes were in April and May 2025. These moves reflect the US State Department’s analysis of how many green cards were available for the EB-5 category and how many applicants were ready to apply. - Visa Bulletin Considers only APPROVED Petitions:

The Visa Bulletin dates are calculated by the Department of State based on information they have from USCIS about approved petitions. These charts do not show the impact of petitions that may have been filed before now, but are not yet approved.

The Visa Bulletin is the end of the story. To know how long a would-be immigrant might need to wait, it’s important to understand how many petitions might be in process ahead of them.

Visa Bulletin is a Toll Plaza on a Highway.

Think of the Visa Bulletin like a toll plaza on a highway. It lists how long the line is at the toll booth and separates the line for specific countries that have a backlog. However, the Visa Bulletin does not show how many cars are on the highway on their way to the toll plaza. Those are the pending petitions. This information is generally not made public, but there have been efforts by EB-5 industry groups to get this information. We will provide our analysis of this information separately.

Concurrent Filing Can Expedite the Process, but only for those in the United States.

Concurrent filing is a mechanism where EB-5 investors already in the United States can send in some forms at the same time as their first Form I-526E application, instead of waiting until that application is approved. With concurrent filing, investors can fill out and send in both their Form I-485 (Application to Register Permanent Residence or Adjust Status) and their Form I-526E petition at the same time.

Generally, this will allow those investors to:

- Travel in and out of the United States without any other visa

- Legally work in the United States without any separate employment sponsorship or visa

- Receive these benefits while their I-526E petition is pending, NO MATTER HOW MANY PETITIONS MAY HAVE BEEN FILED AHEAD OF THEM.

In our metaphor, this means that it does not matter how many cars are on the highway ahead of you. As long as there is not yet a line at the toll booth, you may apply for these benefits. Essentially, if you’re here, you can stay here.

Have questions about EB-5? Visit our website or fill out our contact form.